An ongoing project where we collect facts, insights and perspectives to prepare you to be mentally and financially ready for parenthood.

Choosing to have children with your spouse is one of the most important decisions you can make in your relationship, if not your life. Everything you thought you knew about your way of life is going to change!

Before making any major decisions, it’s a good idea to have an open and honest conversation with your spouse about your views and feelings on the subject. It’s a terrific opportunity to convey your viewpoint while also learning more about your spouse.

It is critical to have an emergency fund in place as it is a financial safety net in the event of an emergency.

This emergency fund can be in form of a bank account containing money set aside for unexpected bills or events.

Having an emergency fund is even more important now that you have children since it must provide for both you and your child.

Discuss the following topics with your partner to get a shared understanding when it comes to joint expenditures.

How much money will we make when the baby arrives?

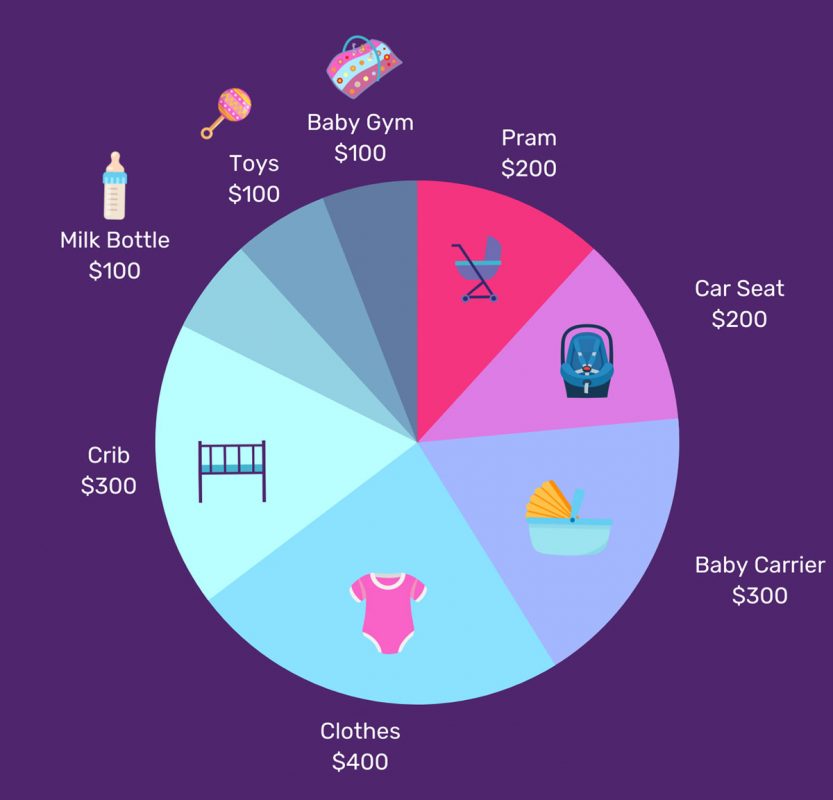

What kind of costs will raising our child incur?

How much is our current monthly spending in total?

Understanding your needs vs. wants while examining this component can help you discover where you can make changes.

Is there enough money to meet new and existing bills once the baby arrives?

It’s a good idea to slightly overestimate new costs. For example, you probably won’t need to buy clothing for the baby every month but set aside a fixed amount in your budget for all of the baby’s requirements just in case.

What can we cut if our expenses are too high?

You don’t have to give up all entertainment and enjoyment because you have a child, but you might want to consider cutting out items like television or other monthly subscriptions, such as magazines, that you can live without.

Are there any costs that we can cut instead of eliminating?

If you love going out to eat on Friday nights or renting movies, bear in mind that you may be able to lessen the frequency with which you do so without completely eliminating them.

Public Hospital

Private Hospital

Diapers

Per Month

Per Month

Grandparents

Per Month

Per Month

Per Month

Per Month

Allowance & Other Expenses

Per Month

Continue Reading: The Maternity Project