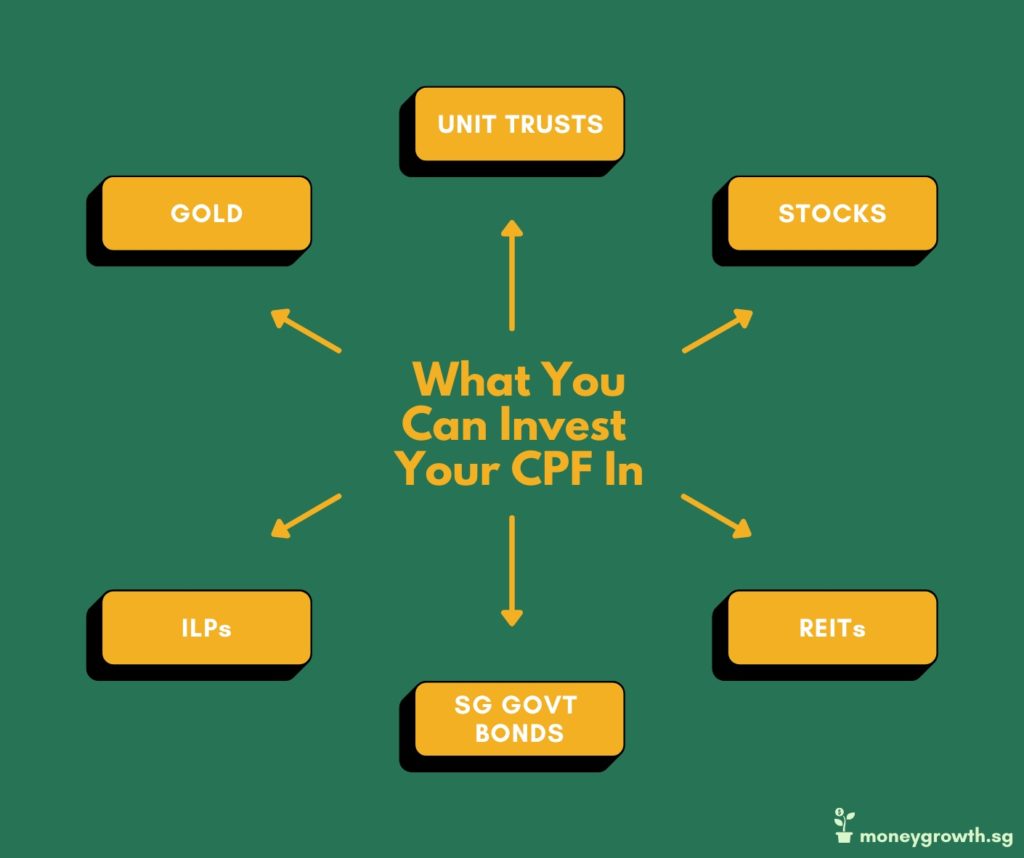

Under the CPF Investment Scheme (CPFIS), you have the option of investing your CPF savings in a wide range of products to meet your retirement financial objectives. You can use your CPF to buy shares, unit trusts and more.

Read on to learn more about the investment products offered under the CPFIS to help you decide on which products to invest in.

If you want to find out how to actually get started investing using your CPF money, read our article: How To Invest Using The CPF Investment Scheme

| Investment product offered under CPFIS | You can invest your CPF savings from your | |

| CPFIS-OA | CPFIS-SA | |

| Unit Trusts (UTs) | Yes | Yes Higher risk UTs not included |

| Investment-linked insurance products (ILPs) | Yes | Yes Higher risk UTs not included |

| Annuities | Yes | Yes |

| Endowment policies | Yes | Yes |

| Singapore Government Bonds (SGBs) | Yes | Yes |

| Treasury Bills (T-bills) | Yes | Yes |

| Exchange Traded Funds (ETFs) | Yes | No products currently available Higher risks ETFs not included |

| Fund Management Accounts | Yes | No |

| Fixed Deposits | No products currently available | |

| Statutory Board Bonds | No products currently available | |

| Bonds Guaranteed by Singapore Government | No products currently available | |

| Up to 35% of investible savings can be invested in: | ||

| Shares | Yes | No |

| Property Funds | Yes | No |

| Corporate Bonds | Yes | No |

| Up to 10% of investible savings can be invested in: | ||

| Gold ETFs | Yes | No |

| Other Gold products (Gold certificates, Gold savings account, Physical Gold) | Yes | No |

Source: CPF Board

For newer investors, the section below summarises some of the key features of the products offered under CPFIS:

1. Unit Trusts (UTs)

A UT comprises money from many investors pooled together as a mutual fund and managed by a fund manager to achieve specific investment objectives. The fund manager is in charge of creating and managing a portfolio of investments and assets and is paid a performance fee to do so.

UTs offer portfolio diversification for investors who have limited time and expertise in managing their own portfolios.

As of Q3-2021, there are 87 UTs included under the CPFIS ranging from low to higher risk. The full list of UTs can be found here.

2. Investment-linked Insurance Products (ILPs)

ILPs have both a life insurance coverage and an investment component.

The premiums you pay for an ILP are used to purchase units in one or more sub-funds of your choice. Some of the units are then sold to pay for your insurance coverage while the rest remain invested. ILPs provide insurance protection in the event of death or total and permanent disorder (TPD).

ILPS do not have guaranteed cash values as the value of units depends on the performance of its sub-funds. ILPs offer investors the flexibility to vary your insurance coverage as your needs change. However, they may not be the best option if you are only concerned about getting insurance coverage.

With effect from 1 January 2001, CPF savings can only be used to purchase Single Premium or Recurring Single Premium insurance policies under CPFIS.

As of Q3-2021, there are 144 ILPs included under the CPFIS ranging from low to higher risk. The full list of ILPs can be found here.

3. Singapore Government Bonds (SGBs) and Treasury Bills (T-bills)

SGBs pay investors a fixed rate of interest semi-annually and have maturities between 2 to 30 years. They are a relatively low-risk form of investment with an AAA credit rating and fully backed by the Singaporean government. SGBs are tax exempt for individuals and can be traded on the secondary market.

T-bills are short term SGBs with 6-month to 1-year maturities. Similar to SGBs, T-bills carry low-risks for investors, have an AAA credit rating and are fully backed by the Singaporean government.

4. Exchange Traded Funds (ETFs)

Similar to UTs, ETFs are funds pooled together by investors to invest in a basket of different assets such as stocks or bonds for portfolio diversification. However, unlike a UT which are actively managed by fund managers, ETFs are often designed to track a particular index, resulting in lower charges and management fees.

There are currently six ETFs under the CPFIS-OA ranging from low to high risk.

5. Gold

Gold is a precious metal that has been used throughout history as both a currency and a store of value. Due to its rarity, it is commonly seen as a hedge against inflation and offers protection for investors seeking to preserve their wealth.

Under the CPFIS, investors can purchase a range of different gold products such as gold ETFs, gold certificates and even physical gold. With a CPFIS-OA account you can directly invest in the SPDR Gold Shares ETF.

However, if you wish to purchase gold certificates or physical gold, you will need a CPFIS-OA account with UOB as it is currently the only agent bank which provides such services.

6. Shares, Property Funds and Corporate Bonds

With a CPFIS-OA account, you can invest in shares and bonds of companies and property funds listed on the Singaporean Stock Exchange (SGX) as long as they meet the inclusion criteria under CPFIS.

To meet the inclusion criteria, the shares/bonds/funds have to be issued by a company incorporated in Singapore, trading on the SGX mainboard and denoted in Singapore dollars.

The full list of shares, property funds and bonds offered under the CPFIS can be found under the SGX Website.

Conclusion

The CPFIS offers a range of different investment products to help you enhance your retirement savings and meet your post-retirement goals. Before deciding to invest, it is key for you to understand the different products and how they might fit into your investment strategy to meet your retirement goals.

Conducting proper due diligence could help you to prevent unnecessary losses and ensure that your plan to retirement goes smoothly.

You should bear in mind that each investment product comes with a certain level of risk and you should only invest what you are capable of losing. If you wish you earn risk-free interest, you can leave your money in your CPF account.

It should also be noted that the CPF Board does not endorse any product providers or investment products that are included under the CPFIS and you should conduct your own due diligence before making your investment decisions. Click this link to find the full list of service/product providers under CPFIS.

To find out more about how to invest your CPF savings, check out our article that talks about the details of investing through the CPF Investment Scheme.