Parenting in Singapore is challenging and expensive, from childbirth to university education and possibly beyond. As parents, we always want the best of everything for our children.

However, it can be draining for our finances and require extensive amount of financial planning. While money should not deter us from having children, it is definitely a determining factor in Singapore for many young couples on whether they want to have kids.

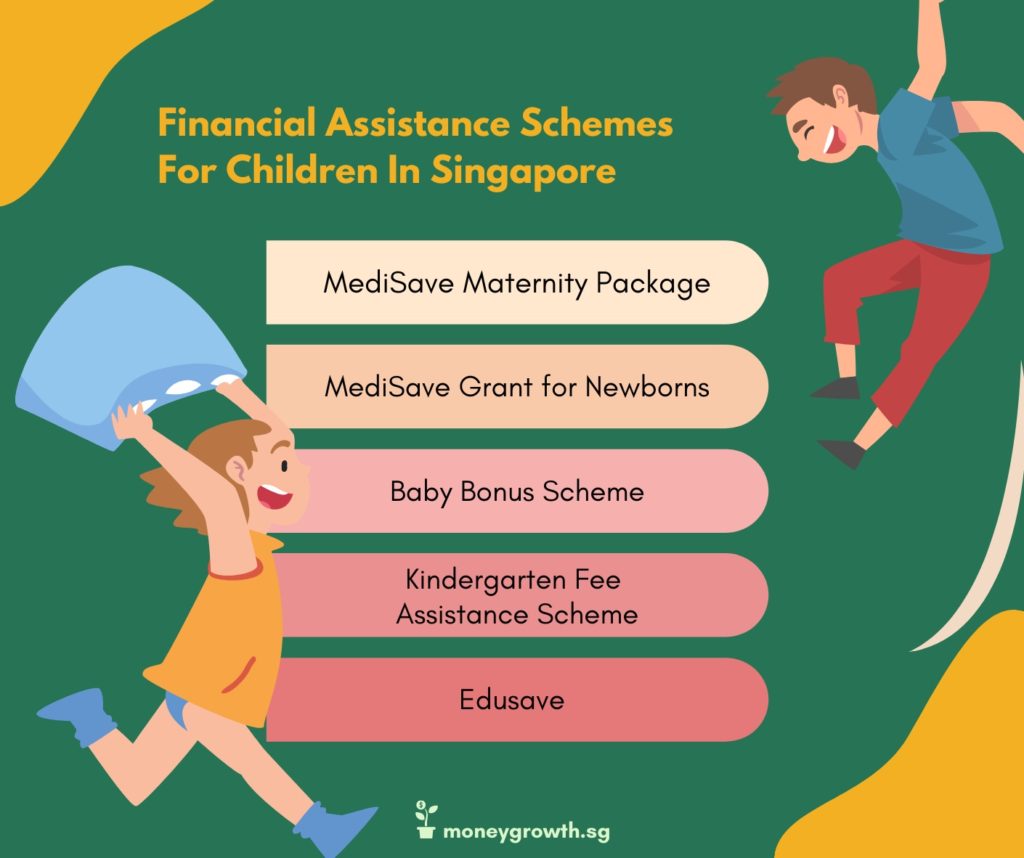

There are many financial assistance schemes available in Singapore, starting from pregnancy all the way to university education.

The Ministry of Social and Family Development (MSF), together with Ministry of Health (MOH), Ministry of Education (MOE) and many other different government agencies have several supporting schemes to help Singaporean couples reduce their financial burden in raising their families.

From Conceiving

Government Co-funding for Assisted Reproduction Technology

Eligible couples (with difficulties conceiving) that are seeking Assisted Reproduction Technology (ART) treatment in public hospitals can receive up to 75% in co-funding from the Government for a maximum of 3 fresh and 3 frozen ART cycles.

Medisave for Assisted Conception Procedures

We can also use our Medisave to pay $6,000, $5,000 and $4,000 for the first, second and third (and subsequent) treatment cycles for Assisted Conception Procedures (ACPs), subject to a lifetime limit of $15,000. Treatments can be received at public and private hospitals using the Medisave of both husband and wife.

On Delivering

MediSave Maternity Package

The MediSave Maternity Package covers delivery expenses, as well as pre-delivery medical expenses such as consultations and ultrasound in public and private hospitals. You may use:

- up to $900 for pre-delivery medical expenses,

- from $750 to $2,600 depending on the type of delivery procedure, and

- up to $550 per day for the first two days of your hospital stay and $400 per day from the third day onwards.

After Delivery

Medisave Grant for Newborns

All Singapore citizen newborns born on or after 1 January 2015 will receive a Medisave grant of $4,000 to be deposited into the Medisave account of the child, which will be automatically created in their name upon registration of birth. This grant can help parents reduce the costs of their child’s healthcare expenses, such as MediShield Life premiums, childhood vaccinations, hospitalisation, and approved outpatient treatments.

MediShield Life

Besides the Medisave grant, all Singapore Citizen newborns, including those with congenital and neonatal conditions, are automatically covered by MediShield Life. Coverage starts from birth and is for life. This will help ease the anxiety of parents who may be worried about medical coverage for their children born with specific health or medical conditions.

Baby Bonus

The Baby Bonus Scheme helps us to manage the cost of raising a child. It comprises of the Baby Bonus Cash Gift and a Child Development Account (CDA). The CDA has two parts, which are the First Step Grant, and the Government co-matching of our savings into this account.

The Baby Bonus Cash Gift ($8,000 for the first 2 children and $10,000 for the third child onward) will be given out in five installments over 18 months, after our child’s birth. The CDA First Step Grant of $3,000 will be automatically deposited when we open the CDA for our child at any of the 3 banks: DBS/POSB, OCBC or UOB.

The Government will also do a dollar-for-dollar matching when we save into our child’s CDA, up to the maximum Government co-matching amount ($3,000 for the first child, $6,000 for the second child, $9,000 for the third and fourth child, and $15,000 for the fifth child onward) before our child turns 12 years old. The savings in the account can be used for:

- Fees for registered childcare centres, kindergartens, special education schools and early intervention programmes

- Medical expenses at healthcare institutions such as hospitals and General Practitioner clinics

- Premiums for MediShield Life or MediSave-approved private integrated plans

- Assistive technology devices

- Eye-related products and services at optical shops

- Approved healthcare items at pharmacies

Savings which is left in the CDA after the year our child turns 12 will be transferred to his/her Post-Secondary Education Account, which can be used to pay for approved courses (e.g. diploma, undergraduate programmes) in approved institutions, as well as to repay Government education loans and financial schemes. If we have not saved up to the co-matching cap of CDA, we can continue to contribute to the Post-Secondary Education Account to receive the matching amount till the cap is reached, or when our child becomes 18 years old, whichever is earlier.

1st 6 Years Of Your Child’s Life

To offset your child’s preschool education fees, you can enroll your child in licensed childcare centres to receive a Basic Subsidy of up to $600/month for full-day infant care, and up to $300/month for full-day childcare. Additional subsidies are available to working mothers with gross monthly household income of $12,000 and lower. Subsidies for half-day and flexi-care programmes in childcare and infant care centres are also available.

If you enroll your child in an Anchor Operator or MOE Kindergarten, you are eligible for the Kindergarten Fee Assistance Scheme (KiFAS) if your gross monthly household income is $12,000 and lower.

7th Years Onward

For all Singapore Citizen students, an Edusave account will be created automatically for them and they can receive an annual government contribution for their educational use, from the start of their primary school education until they complete their secondary school education. Your child’s Edusave fund can be used for:

- Enrichment programmes organised by their schools.

- 2nd-tier miscellaneous fees.

- Miscellaneous fees for autonomous government and government-aided schools.

- Personal learning devices in secondary schools, junior colleges and Millennia Institute under the digital learning programme organised by their schools.

Conclusion

While raising a child in Singapore is not easy, there are many financial support schemes for us to consider and make our journey in bringing up a child slightly easier. For the latest information, do check with the relevant government agencies to keep abreast of schemes to help defray the cost of raising your child.