According to the OCBC Financial Wellness Index 2021 report published in November 2021, more than 51% of respondents listed retirement planning as among their top financial priorities. While 66% expressed that they have made a retirement plan, only 1/3 is on track to achieve their ideal retirement.

Many of us have dreamed of a great retirement lifestyle in which we have the time and money to do what we like after a good stretch of 30-40 years of work. Traveling to experience the food and culture overseas, volunteering for a cause or indulging in your favorite hobby. Whichever retirement lifestyle you choose, you will need the financial support to achieve your goals.

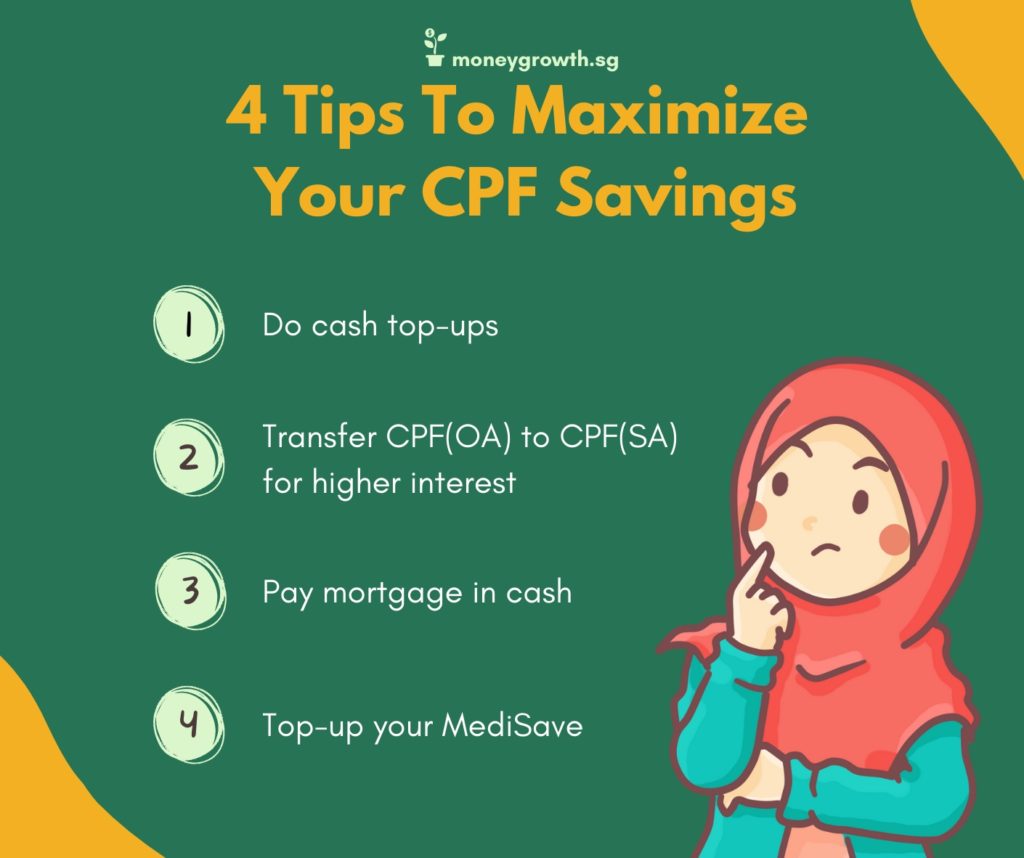

In Singapore, the majority of us will be using our Central Provident Fund (CPF) savings to fund our retirement. Thus, it is important for us to maximise our CPF savings in order to enjoy the retirement lifestyle we seek. The following are some of the ways we can do so.

1. Reduce Your Mortgage Commitments

Most of us will use our CPF Ordinary Account (OA) savings to repay our mortgage. However, some of us may overstretch our mortgage commitments to the extent that we have to use cash to top-up our monthly repayments.

This means we would be unable to contribute to our CPF (OA) account. Thus, we may be losing the opportunity to grow our CPF savings for retirement, especially when we are able to earn 3.5%pa on the first $20,000 in our CPF(OA). This can be a significant difference over a long period of time.

2. Cash Top-ups

In order to take advantage of the guaranteed interest rates provided by the CPF various accounts to grow our CPF savings for retirement, we can make cash top-ups to our CPF via the Retirement Sum Topping-Up Scheme (RSTU) or via Voluntary Contributions.

If you are doing cash top-ups using the RSTU scheme, you can enjoy tax relief equivalent to the amount of cash top-ups made from 1 Jan 2022:

- up to $8,000 per calendar year if you make a top-up to your own account; and

- an additional $8,000 per calendar year if we make a cash top-up for our loved ones.

Only cash top-ups within the current Full Retirement Sum (FRS) are eligible for tax relief. For 2022, the FRS is $192,000.

Please note that if we are below 55 years old, we can only do a cash top-up to the maximum amount of FRS. If we are 55 years and older, we can do a cash top-up to the maximum amount of Enhanced Retirement Sum (ERS). For 2022, the ERS is $288,000.

If we are doing cash top-ups via Voluntary Contributions, only cash contributions to our MediSave account will be tax deductible, subjected to the CPF Annual Limit of $37,740 from January 2022.

3. CPF(OA) Transfer To CPF(SA) Before Age 55

The CPF Ordinary Account (OA) base interest rate is 2.5%pa and the Special Account (SA) base interest is 4.0%pa. If you have no further use for your excess OA savings (beyond mortgage repayments and education funding), you can consider transferring to your SA to earn a higher interest.

It is worthwhile to note that the transfer is irreversible. In another words, once you have decided to transfer that particular amount of OA savings to the SA, you will not be able to transfer that particular amount of money back to the OA. Therefore, please do this with caution. Work with a professional to ensure that any transfer to your SA has been carefully planned for.

4. Purchase A Cash Endowment Policy For Your Children

If you are planning for your children’s education funding, it may be better to purchase a cash endowment policy for them instead of utilising your CPF(OA) savings when they are ready to enter local tertiary education.

By doing so, any excess CPF(OA) savings can be transfer to CPF(SA) to accumulate higher returns. Moreover, a cash endowment policy can be used for overseas education funding which the CPF Education Scheme does not allow.

5. Delay Receiving CPF LIFE monthly Payouts

CPF Lifelong Income For Elderly (commonly known as CPF LIFE) is a national-wide annuity scheme that ensure that CPF members are able to have a continuous stream of income to maintain their retirement expenses.

If you have other financial resources to sustain your retirement lifestyle, it may be a good idea to delay receiving your CPF LIFE monthly payouts till age 70. Doing so will allow more interest to be accumulated into your CPF LIFE and it will allow you to enjoy bigger monthly payouts.

6. Invest Using CPF Investment Scheme (CPFIS)

After setting aside our CPF savings for mortgage repayments, we can invest in CPFIS approved financial products to enhance the returns of our CPF savings. Read more about investment products under the CPF Investment Scheme here.

It is important that we take a long-term investment perspective, instead of a short-term speculative approach. It would be best to do your own research or engage a financial professional to help you invest into high potential financial instruments.

Understanding your own risk profile is equally important. If you are not comfortable with the investment risk, then it is still worthwhile to stay with CPF risk-free returns.

With the above suggestions, you can further maximise your CPF savings to grow your retirement fund in order to enjoy the desired lifestyle during your golden years.