Now that you have completed your education, got a job and saved some money, what is the next item on your adulting checklist? As life can throw us many unexpected challenges, getting insurance can help you to prepare for the unexpected while you work towards your financial goals.

With so many different types of insurance products in the market, it can get very confusing making it difficult for many people to know what kind of insurance they should get or need.

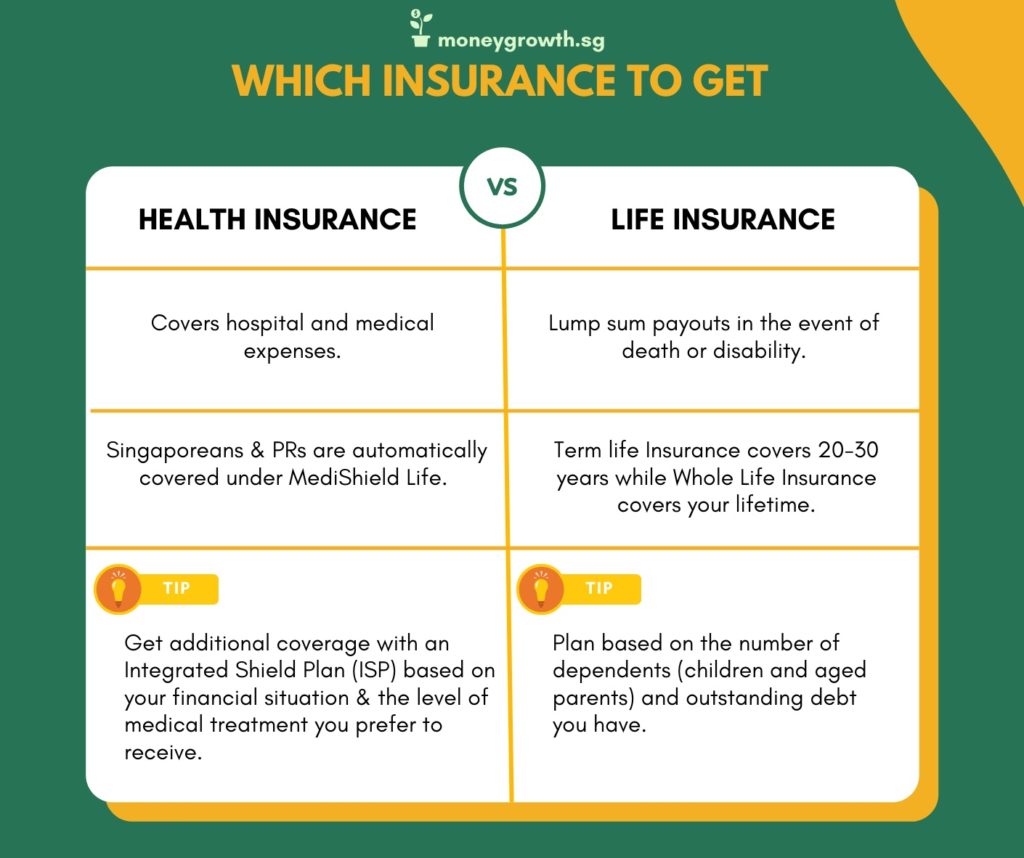

In this article, we aim to provide you with the knowledge to distinguish between two important types of insurance products: health and life insurance. And how each type of insurance may be applicable to your life.

Health Insurance

Health insurance, also known as medical insurance, helps to cover your hospital and medical expenses should you happen to fall ill.

Singaporeans and Permanent Residents (PRs) are automatically covered under MediShield Life, which is a basic health insurance scheme that provides lifelong coverage against large healthcare bills regardless of age or health condition. The premiums for MediShield Life are automatically deducted from your MediSave account under the CPF administration scheme.

However, as MediShield Life only provides basic healthcare coverage, you may choose to purchase an Integrated Shield Plan (ISP).

ISPs serve to complement your basic health plan and provide additional private insurance coverage. Depending on your plan, ISPs and riders can provide coverage for higher ward classes or stays at a private hospital, higher annual claims limits and many more benefits.

Before making a decision on which health insurance to purchase, you should consider your financial situation and the type of medical treatment you would like to receive. While ISPs provide better coverage, premiums are higher than MediShield Life and will increase as you get older.

Statistics show that up to 60% of Singaporeans who have an ISP do not end up staying in the wards that their coverage entails them to!

Therefore, while ISPs provide better insurance coverage, they may not be specific to your financial needs and the type of medical treatment you wish to receive.

Life Insurance

Life insurance is a form of insurance which provides lump sum payouts in the event of death or total and permanent disability (TPD). There are two different types of life insurance, namely term life insurance and whole life insurance.

As its name suggests, term life insurance lasts for a term period of around 20 to 30 years. During this term period, you will be covered for death and TPD as long as you continue to pay your premiums. The premiums for term life insurance are low and the policy does not accumulate any cash value.

On the other hand, whole life insurance lasts for your entire life and also usually involves an endowment or investment portion to the policy. This means that while the policy accumulates value, the premiums are also higher than term life insurance.

Which Insurance Policy Should I Get?

While there is no straightforward answer to this question, it very much depends on your financial situation and stage of life you are at. As life can be unpredictable, it is better to be prepared for the worst than to be caught in a precarious financial situation.

Health insurance is easily affordable and can ensure that you are well protected in the event of a serious illness.

Whether or not to get life insurance depends on the number of dependents you have and whether you have any outstanding debts and loans. As you progress in life, you will gain more dependents as you begin to raise a family and support your aging parents.

Therefore, you should always think about what would happen to your dependents if you suddenly cannot provide for them any longer. If you suddenly pass away or lose to the ability to work due to permanent disability, life insurance ensures that your dependents have a source of funds which they can rely on to deal with outstanding debts or losses of future income.

When Is The Best Time To Get Insurance?

Many people put off getting insurance because they do not see it as important while they are still young and healthy. However, it might actually be better to get insurance at a younger age since premiums are lower and you are less likely to have a pre-existing medical condition.

Getting insurance early can help to unlock additional savings and lock in your premium rate for the entire duration of your policy. Therefore, you should not overlook the importance of insurance and consider getting it as early as possible for a peace of mind in the event of a medical emergency.

Conclusion

In this article, we have highlighted the key differences between health and life insurance and how they might provide you with financial security during unexpected medical emergencies.

Before purchasing health insurance, you should always consider your own financial situation and type of medical treatment you want to receive in the future.

For life insurance, it is important to consider the financial situation of your dependents and whether they can provide for themselves in the event that you are suddenly unable to work anymore.